Praetura Growth VCT

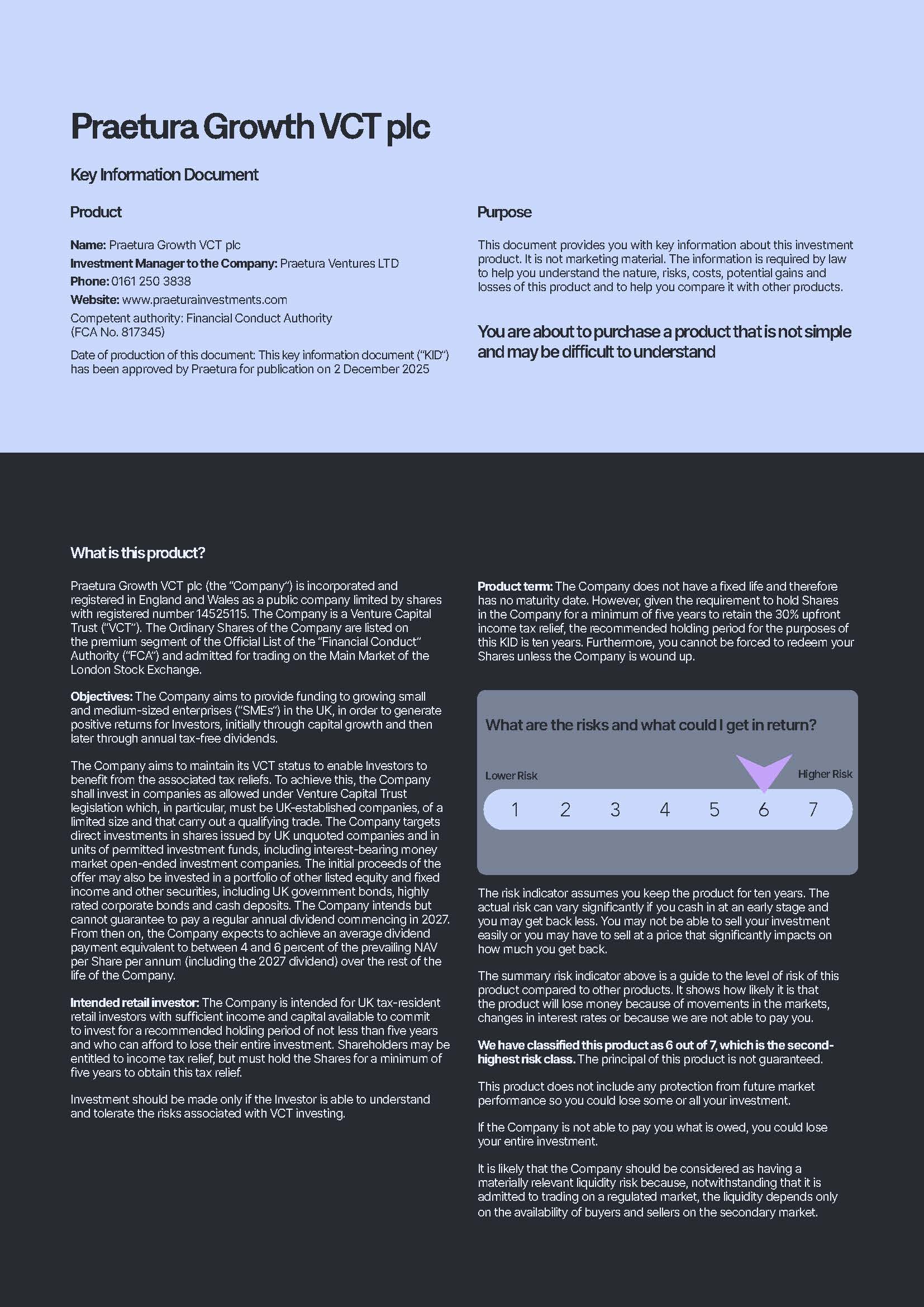

About Praetura Growth VCT plc

Geographic Diversification powered by the PXN Group

Investors in Praetura Growth VCT support scalable businesses predominantly across the North of England and Scotland, capitalising on the structural funding gap outside London while targeting tax-efficient returns.

Now part of the PXN Group, the Manager oversees approximately £660m in assets and leverages a track record of over £400m invested directly into UK companies. This enhanced platform provides investors with proprietary deal flow and ensures portfolio companies receive hands-on support from over 110 Operational Partners through our ‘More Than Money’ guiding principle.

Since launching in April 2024, the Praetura Growth VCT has invested in 11 companies and has a strong pipeline of potential investments. Here are some of the portfolio companies that we’re excited about:

AccessPay

Manchester-based AccessPay is a global leader in financial digital transformation for finance and treasury teams. Its platform automates business payments, collections and cash management through a secure and flexible banking integration solution. Customers include ITV, Admiral, The AA and Sainsbury's.

Seatfrog

Seatfrog's platform allows rail passengers to upgrade seats, switch trains or access discounted fares. It generates incremental revenues for operators while providing a better passenger experience. The business was profitable in 2024 and remains on a growth trajectory despite industry-wide headwinds.

Ocula

Ocula develops AI solutions for ecommerce retailers, automating and optimising product page content at scale. Clients include Boots, ASDA, AO and LK Bennett. Ocula has optimised over five million product listings to date, achieving a 5-15% average increase in traffic and revenue for clients.

£3,000

Minimum investment

30%

Upfront income tax relief on investments of up to £200,000 per tax year

100%

Tax-free capital gains on the disposal of shares

2%

Early bird discount on the Initial Fee until 1 April 2026

Tax benefits are subject to change and depend on the individual's circumstances. Past performance is no guarantee of future returns.

Caroline Flagg speaks about the what Venture Capital Trusts (VCTs) are

In this video, Business Development Manager, Caroline Flagg, explains what VCTs are.

Our Approach

Praetura Growth VCT leverages the combined strength of the PXN Group, formed by the union of Praetura Ventures and Par Equity. This partnership creates one of the UK’s largest regional venture capital managers, with a combined track record of over £400m invested in early-stage companies.

Our strategy focuses on backing exceptional founders predominantly in the North of England and Scotland—regions rich in innovation but historically underserved by capital. We apply our rigorous ‘6M’ investment framework to identify high-growth potential and drive value through our ‘More Than Money’ active management support.

Examples of PXN Group’s previous exits

Past performance is no guarantee of future returns. Returns shown are examples achieved by the wider PXN Group.

Download our documentation

Latest News

FAQs

- 30% upfront income tax relief on the amount invested, subject to a maximum investment of £200,000 per tax year

- 100% tax-free dividends from the VCT

- 100% tax-free capital gains if selling the shares

| Initial: | Initial fee | 3% | of amount subscribed |

| Ongoing | Annual management fee | 2% (plus VAT if applicable) | of net asset value p.a. |

| Administration fee | 0.35% (plus VAT) | of net asset value p.a. | |

| Performance fee | 20% | of amounts in excess of 120p per Ordinary Share |

- Tax reliefs: Tax reliefs are not guaranteed, depend on the VCT maintaining its VCT qualifying status, the individuals’ personal circumstances and a five-year minimum holding period, and may be subject to change. In the event of the VCT losing its VCT qualifying status or an investor disposing of their shares within 5 years of issue they will be subject to a clawback from HMRC on tax relief claimed.

- Liquidity: It is unlikely there will be a liquid market in the ordinary shares of Praetura Growth VCT and it may prove difficult for investors to realise their investment immediately or in full.

- Capital at risk: An investment in Praetura Growth VCT involves a high degree of risk. Investors’ capital may be at risk.

- General: Past performance of Praetura Ventures in relation to its other EIS qualifying investments is no indication of future results. The payment of dividends is not guaranteed. Investors have no direct right of action against Praetura Ventures. The Financial Ombudsman Service/the Financial Services Compensation Scheme are not available.

Speak to the Praetura Team

forum

Call Us

Speak to one of the team via 0161 250 3838